There are growing signs that 2026 could mark the beginning of the return of Red Sea Container Shipping. However, this will not be a clean switch back to “business as usual.” Instead, shippers should expect a phased, uneven, and data-sensitive transition, one that introduces both opportunity and risk across global trade lanes.

A Fragmented Return Led by Carrier-Specific Strategies

The early signals are clear: carriers are not moving in unison.

Some, like CMA CGM, have openly resumed select services through the Suez Canal, reducing round-trip transit times and freeing up vessels in the process.

Others, including Maersk, are quietly testing Red Sea transits without formal announcements. These unannounced or “dark” sailings allow carriers to assess risk, but they introduce operational uncertainty for shippers and ports alike, especially when cargo arrives earlier than planned. For shippers, this lack of alignment means one thing: the same trade lane may behave very differently depending on the carrier and even the specific sailing.

Why a Full Red Sea Normalisation Is Still Distant?

Despite recent headlines, a full-scale return to pre-crisis Red Sea operations remains some distance away.

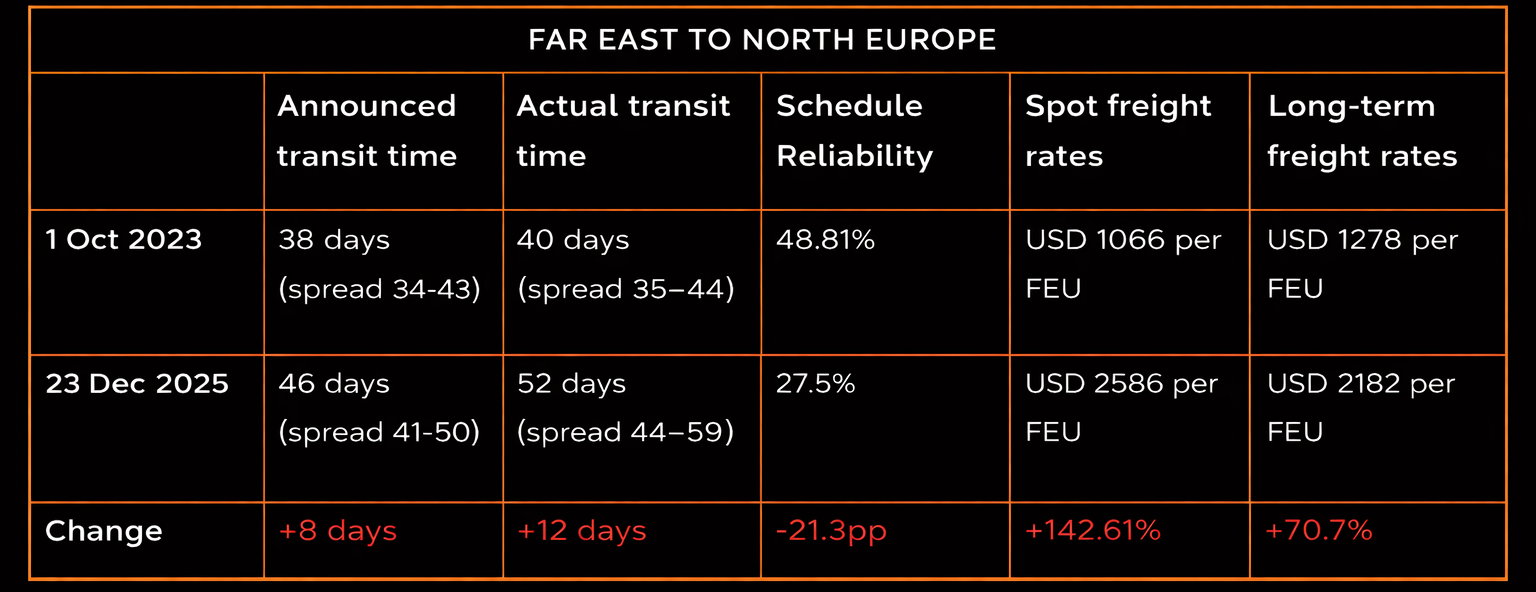

While container ships have continued to transit the Suez Canal during the crisis, volumes are still far below 2023 levels, and largely limited to lower-risk regional trades. Key performance indicators reinforce this reality:

- Transit times to Europe remain materially longer

- Schedule reliability has deteriorated sharply

- Spot and long-term freight rates are still significantly higher than pre-crisis benchmarks

In practical terms, this means shippers should not plan their supply chains on the assumption of near-term normalisation.

The Hidden Operational Impact of Shorter Routes

As more services begin routing through the Suez Canal instead of the Cape of Good Hope, transit times will compress, but not uniformly.

This creates a new challenge: cargo arriving earlier than expected, sometimes by as much as a week. When multiple services readjust simultaneously, ports could experience sudden congestion as vessels converge unexpectedly. The industry may see a reversal of the congestion patterns experienced in 2024, with risk shifting from elongated voyages to synchronized arrivals.

Timing will be critical. A post-Lunar New Year transition would allow networks to absorb disruption during a seasonal demand lull. A pre-holiday adjustment, however, would significantly raise the risk of delays and bottlenecks.

Capacity, Rates, and the Tendering Dilemma

The return of Red Sea Container Shipping frees up vessels, and that matters.

Each shorter routing effectively releases capacity back into an already oversupplied market. This increases downward pressure on freight rates and complicates long-term contracting decisions for 2026.

For shippers entering tenders, flexibility becomes essential. Index-linked contracts, predefined renegotiation triggers, and market-based adjustment mechanisms can help manage volatility. Just as importantly, surcharge structures need scrutiny.

If Red Sea transits resume at scale, shippers must ensure contracts clearly define how and when Red Sea surcharges will be reduced or removed. Without this, there is a real risk of paying crisis-era surcharges long after the underlying risk has disappeared.

Why Freight Intelligence Matters More Than Ever

The coming months will not be defined by rates alone.

Transit time variability, schedule reliability, and early indicators of service changes will play a decisive role in supply chain planning. With the same service potentially operating under different routings week to week, maintaining a clear view of cargo movement becomes increasingly complex.

This is where Lynkit XBL becomes critical for modern shippers and forwarders. By combining market-validated rate intelligence with lane-level visibility, Lynkit XBL helps decision-makers track shifting carrier behavior, anticipate cost movements, and respond proactively, rather than reactively, to network changes.

As Red Sea dynamics evolve, the winners will not be those chasing the lowest rate, but those equipped with the clearest intelligence.

Because in volatile markets, visibility is not an advantage. It is a requirement.